While financial worries may have many of us losing sleep, it’s never too late to start building a better financial future. Whether you’re saving towards a house deposit or perhaps thinking much longer term to your retirement, it’s important to start thinking about how you can make your money work harder and smarter for you. Many will be putting their hard earned cash into a standard savings account or cash ISA.

A standard savings account on average offers an interest rate of only 1.39% (less than inflation meaning your money actually loses value in the long term). A standard savings account is also subject to tax – yet another thing which will eat away at your hard earned money. When it comes to cash ISAs, these benefit from slightly higher returns – some banks offer them at 1.7%, but your money is locked away for a number of years. Not only are these returns not particularly attractive, but in many cases, there are heavy penalties if you take out your money before an agreed time and there may be fees to pay.

The average house price in the UK is £235,298, making the average deposit £35,294 (15%). Looking at the value of property, according to a recent report, average house values grew by 33% between 2010 and 2019 and, though house price growth has slowed in recent years, January figures show an average annual increase of 1.9%. These numbers may seem daunting, but there are options which help savers make the most of what they put away. One of these options is investing and now it’s easier than ever to invest and enjoy the long term benefits that investing in the stock market offers. This could be through investing in stocks and shares or taking advantage of the tax free benefits of stocks and shares ISAs – basically the same thing but there’s the advantage of not having to pay tax on investments under the annual threshold as they benefit from a tax free wrapper. And, thanks to apps like Trading 212, it couldn’t be easier to invest what you have in what you want – even if it’s just £1 – without having to pay any fees.

The average house price in the UK is £235,298, making the average deposit £35,294 (15%). Looking at the value of property, according to a recent report, average house values grew by 33% between 2010 and 2019 and, though house price growth has slowed in recent years, January figures show an average annual increase of 1.9%. These numbers may seem daunting, but there are options which help savers make the most of what they put away. One of these options is investing and now it’s easier than ever to invest and enjoy the long term benefits that investing in the stock market offers. This could be through investing in stocks and shares or taking advantage of the tax free benefits of stocks and shares ISAs – basically the same thing but there’s the advantage of not having to pay tax on investments under the annual threshold as they benefit from a tax free wrapper. And, thanks to apps like Trading 212, it couldn’t be easier to invest what you have in what you want – even if it’s just £1 – without having to pay any fees.

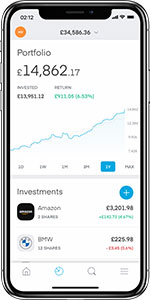

Trading 212 the UK’s leading investment app which lets you invest in what you want – even the biggest companies out there – without paying any fees or commission. This includes stocks and shares ISAs which offer a tax-free wrapper on your savings and fractional shares – buying a portion  of a share or multiple percentages of a share in high value shares such as Tesla or Amazon, so you can spread your investment and still receive any associated dividends. Investing in stocks and shares offers much higher returns over the long term than cash, meaning you can reach your goals sooner. There’s also the added benefit of compound interest so you can earn a passive income - all you need to do is reinvest dividends to get additional benefits. In fact, if you were to invest £5 per day from when you first start working in your twenties after university you could retire a millionaire. Breaking this down, 44 years (basically from 22 to 66) of cash saving £5 per day would give you just over £80k without factoring in interest or tax, which just goes to show that investing really could make your money work for you. And, should something unexpected happen, Trading 212 will let you access money invested in stocks and shares quickly and easily. You aren’t locked in, it’s easy to use, completely transparent, there are zero fees and you can get started with just £1.

of a share or multiple percentages of a share in high value shares such as Tesla or Amazon, so you can spread your investment and still receive any associated dividends. Investing in stocks and shares offers much higher returns over the long term than cash, meaning you can reach your goals sooner. There’s also the added benefit of compound interest so you can earn a passive income - all you need to do is reinvest dividends to get additional benefits. In fact, if you were to invest £5 per day from when you first start working in your twenties after university you could retire a millionaire. Breaking this down, 44 years (basically from 22 to 66) of cash saving £5 per day would give you just over £80k without factoring in interest or tax, which just goes to show that investing really could make your money work for you. And, should something unexpected happen, Trading 212 will let you access money invested in stocks and shares quickly and easily. You aren’t locked in, it’s easy to use, completely transparent, there are zero fees and you can get started with just £1.

Comment from Ivan Ashminov, Co-founder, Trading 212.

- Log in to post comments